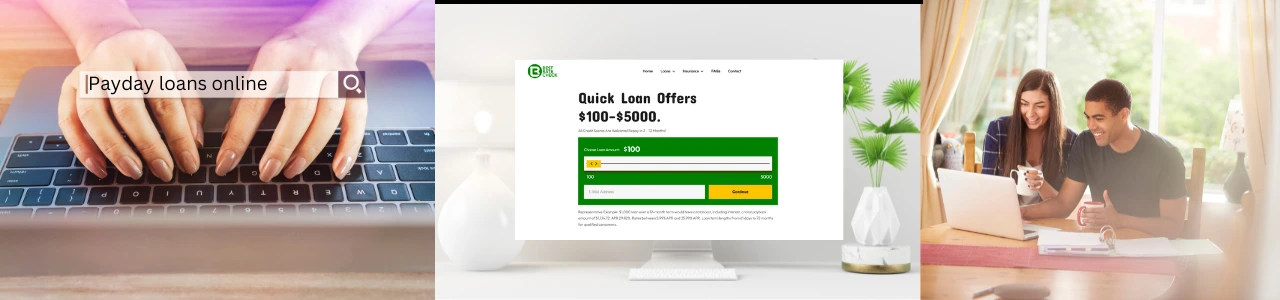

Need Cash NOW? Get $100-$5,000 with Payday Loans Online!

Apply Here,

Quick Loan Offers $100-$5000.

All Credit Scores Are Welcome! Repay In 3 - 72 Months!

Representative Example: $1,000 loan over a 12-month term would have a total cost, including interest, a total payback amount of $1,134.72. APR 29.82%. Rates between 5.99% APR and 35.99% APR. Loan term lengths from 61 days to 72 months for qualified consumers.

Struggling to pay your bills? What if we told you that getting the cash you need through online payday loans is as easy as adding one and one? Because it is!

When you’re in a bind, taking a payday loan online might help cover those extra costs or at least provide a cushion to lean on until your next paycheck. The best part is that you don’t have to visit multiple banks, wait for approval, or deal with frustrating paperwork.

Applying for our payday loans is straightforward, and we connect you to the best lenders in the market, shortlisting only those offering fair terms. So, you can rest easy knowing you’re in safe hands while borrowing the cash you need. You’ll be approved quickly—often within minutes—and receive your funds on the same day.

What Are Online Payday Loans?

Applying for a bank loan when you need only a few hundred dollars might seem ridiculous; that’s precisely why cash advances were created. This is how most online payday loans work: you can borrow smaller amounts (usually between $100 and $1,500), and you need to repay in a lump sum (with interest) on your next payday.

However, if you look closely, this arrangement isn’t ideal for borrowers. How can anyone pay back a couple hundred dollars in just a few weeks, especially with interest rates exceeding 400 percent annually? This is what causes debt.

We’re here to help borrowers tackle this challenge! Our team always looks for lenders with the best interest rates and flexible repayment options. This way, you can pay back in small, manageable monthly installments. You will get the funds you need without worrying about getting caught in a debt trap.

How Our Payday Loans Work

While hundreds of lenders are available, applying through us will help you avoid predatory ones. We select lenders who offer instant payday loans online with no credit check, guaranteed approvals, and borrower-friendly repayment schedules.

To apply, you must complete an online application form, provide us with an email address where you wish to be contacted, and indicate the loan amount you need. Yes, it’s that simple! Once you submit your loan request, it will be sent to multiple lenders to check where you’ll get the best terms.

Lenders will contact you to discuss the loan terms you qualify for and send you an agreement. This document mentions the interest rate, repayment schedule, late payment penalties, and other terms. Read this copy carefully to understand if everything fits into your monthly budget. The funds will be sent to your bank account when you sign the documents.

Basic Eligibility Requirements

To get a cash advance online, the criteria are pretty simple. You must:

- Be 18 or older

- Have a valid government-issued ID

- Have stable income

- Show proof of residence

That’s all you need to get online instant loans. Our payday loans have no credit check requirements, so even people with poor credit scores or low credit history are welcome to apply!

Costs & Fees You’ll Encounter

Taking payday loans online for bad credit may seem enticing, given you’ll get approved quickly. But we also want to make sure that you know the fees involved apart from the interest rate:

- Finance charges

- Late payment fees

- Rollover or renewal fees

- Insufficient funds fees

- Application or processing fees

Usually, the interest rate, finance charge, and application fees are combined into an Annual Percentage Rate (APR).

Before agreeing to anything, you must use this percentage to compare different payday loan options. The lower this rate is, the less you’ll end up paying as a cost for borrowing the loan.

If you want to pay lower fees and interest, check out our title loans in the USA. These loans let you borrow money using your vehicle’s title as collateral.

Pros of Taking Payday Loans

Here are the benefits of taking out fast payday loans online:

-

- Quick access to cash (same-day)

- Minimal documentation

- No collateral needed

- Fast approval process

- No credit checks

- Convenient online applications

- Installment loans online let you pay back in monthly payments

Risks of Online Payday Loans

- High interest rates

- Short repayment terms

- Risk of debt cycle

- Additional fees for rollovers

- Negative impact on credit score (if unpaid)

- Limited borrowing amounts

At Best Rate Check, we highly limit predatory lenders from approaching you. Our team constantly filters lenders who charge higher interest rates, offer short repayment terms, or charge excessive fees. You don’t need to worry about falling into debt as long as you read the documents before signing anything and borrow responsibly.

How to Avoid Getting Trapped in Debt Cycles?

While our quick cash advances already safeguard you from lousy loan terms, it is still essential to follow the best practices while you borrow:

- Borrow only what you need and can repay on time.

- Don’t skip reading documents that mention your loan terms.

- If you’re unclear about the fees or interest rates, ask.

- Plan your repayment budget way before you borrow.

- Avoid rolling over your loans.

- Choose lenders who offer transparent terms.

- Never use cash advances for everyday expenses.

Consider alternatives like online personal loans before borrowing.

Alternatives to Try Out

Before you choose to take out a payday loan, consider these options as well:

- No credit check, unsecured personal loans

- Family or friend loans

- Credit card cash advances

- Salary advance from your employer

- Sell unwanted electronics or jewellery

How to Spot a Reliable Lender?

You can proceed taking a payday loan online with no credit checks when:

- Loan terms and fees are transparent

- Lender is licenced

- There are no hidden charges

- Repayment terms feel reasonable

- Customer reviews are positive

- The lender has an accessible contact method

- The lender is not pressuring you to take the loan

- The online application process is secure

Apply Today—It is Completely Free!

Now that you understand how taking our payday loans online works, you can make an informed decision about your finances. Applying online won’t endanger you because our website uses 256-bit encryption to safeguard your data.

It is free of cost to apply through us and target multiple reputable lenders. We make sure that the information you share with us stays between the three—lender, you, and Best Rate Check. Moreover, we only ask for your email and the loan amount you need.

You can submit your loan application and get approved in minutes in just a few clicks!

Frequently Asked Questions

- What is the finance charge on a payday loan?

The finance charge depends on your loan amount and your chosen lender. Usually, lenders tend to charge you $10-30 for every $100 you borrow. - What is the grace period on a payday loan?

Unfortunately, most payday loans don’t have a grace period. If you don’t pay back on time, late fees will apply. However, our loans allow you to pay back in installments, making repaying more manageable. - What is the late fee on a payday loan?

The late fees for no denial payday loan from a direct lender are mentioned in the loan agreement itself. Often, these are just a percentage of the loan amount. So, how much you borrow also affects the late fee charged if you don’t repay. - How much would a $500 payday loan cost?

The cost of a $500 loan depends on the lender and the APR (Annual Percentage Rate). Typically, you can expect to pay up to $50 in fees. - What do you need for a payday loan?

The requirements for getting approved for a payday loan are essential. You must be over 18, have a stable monthly income, and show proof of residence. - Is a payday loan installment or revolving?

Unlike credit cards, payday loans are installment loans, meaning there is a fixed repayment date by which you need to repay. - Do payday loans check credit?

No! Most payday loan lenders don’t run a credit check before approving your loan request. This makes them easy to get, and you can choose them quickly when you need money. - Are payday loans secured or unsecured?

Payday loans are unsecured; you don’t need to offer collateral to borrow them. - Can a payday loan sue you after 7 years?

A lender has rights to sue you within the statute of limitations, which varies by state, but they’re usually for 3-6 years. - Do payday loans affect your credit?

Payday loans don’t affect your credit score as long as they’re not reported to the credit bureaus or you default. However, your credit score will be negatively affected if you fail to repay. - How many payday loans can you have?

The number of outstanding payday loans you can have varies by state. Some states allow this, while others don’t. Also, it is not recommended to take multiple loans as that can lead to debt problems. - Can you go to jail for not paying payday loans?

No! You won’t go to jail if you’ve simply failed to repay your payday loan. However, it can cause legal actions like wage garnishment if the lender chooses to take the matter to court. - Can you get two payday loans from different places?

Yes, if you want to, you can borrow two payday loans from different lenders. However, it might lead to financial strain and is generally not recommended.