Ever felt that you want to take a trip to Italy in the middle of the week, retire early, or buy a house as if it was no big deal? But then you realise, “Wait a minute. Can’t do that. What about my job? What about the savings I’ve built until now by working so hard? How will I afford the costs?”

When you’re financially free, you can go after your desires and goals, without having to worry about money. That is what it means. Not having to think about a job, staying in a particular city, checking the back of a grocery item for the price before you buy it, and other such stuff. These are all common feelings, and most of us have them when going about life.

Different people surely have different dreams, and financial freedom doesn’t look the same for everyone. But mostly, it comes down to not having a traditional 9-5 job, and being able to pay for your monthly expenses comfortably, without constantly checking your bank balance.

Someone may want to start a business, someone else may want to travel the world, another person might want to pay for their child’s education easily, and so on. The goals are different, but the problem is the same old—not having enough money to support the lifestyle you want so badly.

In this article, we’ve explored the possibility of attaining financial freedom through simple, consistent shifts in your spending habits, mindset about money, and if loans can help you. If you’re ready to take back control over your life, this guide is the magic wand you’ve been looking for.

What is financial freedom?

Before we move on to how to become financially free, let’s define financial freedom in a way that makes sense in your personal situation. Financial freedom is when:

- You have enough savings and investments to cover your living expenses. Your passive income allows you to quit your job.

- Working is no longer a necessity, it becomes a choice.

- You can make choices based on your desires and goals in life, rather than from how much things cost or whether they’ll come at the cost of affecting your financial health.

- You’ve mastered budgeting, debt management, investing early, and consistently living below your means. You’re finally free from “the matrix”!

Financial freedom vs. financial independence

Not to confuse financial freedom with financial “independence”. They’re not the same things. Financial independence is all about not depending on anyone financially. Mostly, women, children, young adults and adults who do not earn are financially dependent. Either on their spouse, or their parents. They cannot pay for rent, utilities, groceries, clothing, etc. by themselves.

Anyone who earns for themselves, and pays for at least the most basic expenses on their own is considered to be financially independent. Not everyone who is financially independent is also considered financially free. They may be able to pay for their living costs, but they may still be far away from the lifestyle they wish to live in the future.

The roadmap to financial freedom

Financial freedom—these two words are enough to draw in a person’s curiosity. Nobody can shake it off and look away. We all want to get rid of that daunting feeling of not having enough money. But, did you know that if you have more money, you’ll need more money?

Clearing out the basics first

Before we move on to giving you the secret soup that takes all your money problems away, and makes your life taste like freedom, we need to shed the layers of societal conditioning. What we mean is, you need to drop certain habits, and shift your mindset regarding money.

First of all, come to terms with the amount of money you truly need every month in order to pay for everything you want, besides everyday expenses. Many times, we lie to ourselves about the amount of money we truly need in order to get rid of that weight of not having “enough money”.

There is an ongoing gap between the financial goals you have set for yourself and the lifestyle you actually wish to pursue. How will it work then? Even if you start making the money you’ve tasked yourself with right now, it still wouldn’t be enough. Then comes the cycle of lifestyle inflation.

So, what can you do?

Get real about your financial goals.

Plan. According to a study by the University of Scranton, 92 percent of those who couldn’t achieve their financial goals failed due to lack of planning. Not having a money plan leads to everything you later regret—overspending, buying things you don’t actually need, impulsive spending, etc.

Sit down, grab a pen and paper, and get real. Be honest about the lifestyle you wish to have, let’s say, 5 years from now. And then you know the actual goal. Until you reach that, don’t overextend yourself. You don’t need to attend that party, or spend on that overpriced dish on date night.

Remember this one thing—once you’re truly financially free, you’ll be able to afford all of that without regretting the purchase. You will truly be able to enjoy that expensive car, or the 2-bedroom apartment overlooking NYC buildings through large windows. You just need to be patient.

Mindset shifts about money (that help)

Here’s what will bring you closer to financial freedom:

- Cut down on non-essential expenses like entertainment, subscriptions, meals out, travel, and shopping. This will help you regain control over your finances. Your money should only go towards things that are of personal value, or the ones you absolutely need.

- Increase your savings by building an emergency fund, contributing more towards retirement plans, or padding taxable investment accounts.

- This couldn’t be stressed on enough—make a realistic budget, and stick to it!

- Automate financial tasks like making monthly payments for debt. Reduce and try to eliminate bad debt like credit card balance, car loans, personal loans, etc.

- Don’t spend out of your means.

- Practice delayed gratification. You don’t need to buy everything you want today itself!

- Use the popular 50/30/20 rule for spending in needs, wants, and savings each month. To take it further, you can aim to spend no more than 60 percent of your monthly income towards all expenses in total. The rest 40 percent can go for savings or investments.

- Don’t set things in stone. Review your budget regularly. Make adjustments wherever needed.

- Lastly, yet most importantly, invest your money wisely. This is what will significantly bring you closer towards financial freedom and build lasting wealth.

Avoid the temptation to buy luxury items at all costs. You will like the new purchase for a few days and later get bored of it anyways. Clear out bad debts as soon as possible, because the interest will keep holding you down, and having lesser debt improves your credit score.

Aiming for financial freedom while you’re in debt is like trying to fly with an anchor tied to your wings. First lighten your load to soar!

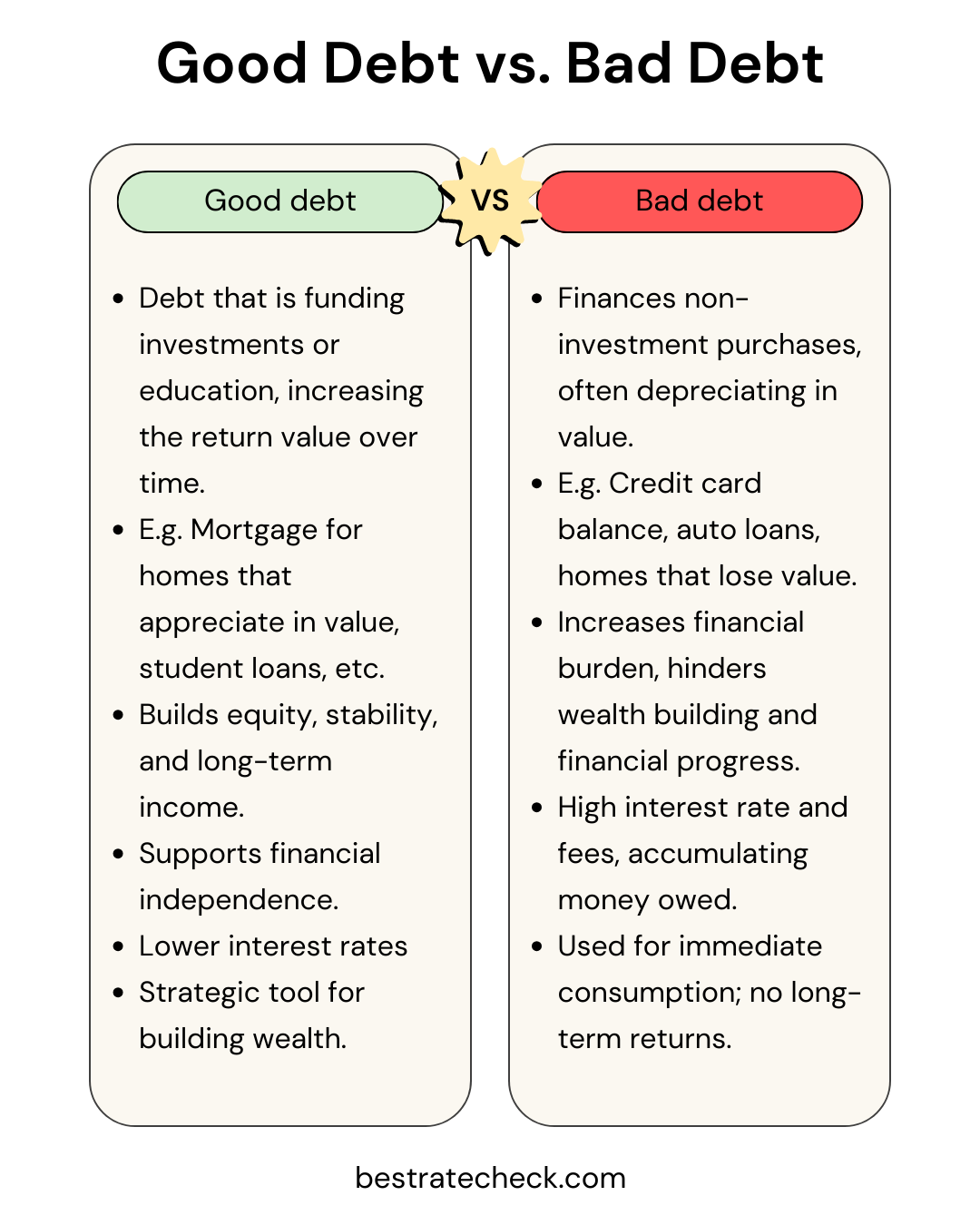

Difference between good & bad debt

Sure, debt is considered a financial burden of sorts. And it is, if you haven’t made enough calculations backing it. Debt can be useful too, if taken strategically.

Can loans be used for building wealth?

From the comparison above, maybe you understood that not all debt is bad. When you’re taking it strategically, it can actually be a tool for building wealth. You’ll get closer to financial independence quicker. Financially smart people know how to leverage “good debt” for income-generating investments.

For example, a personal loan can help you consolidate high-interest debt, fund profitable ventures, or finance home improvements that increase your home’s value when selling it. Mortgage and business loans can help you build your credit history, further supporting your financial goals.

When you’re using the debt to invest in your business’s growth, you’re indirectly increasing your future earnings. The extra surplus can cover the debt, plus be profitable. Not just that, if you’re using debt to make investments like real estate or stocks, the returns could be exponential.

However, some of the options we’ve mentioned above come with their own risks. So, you first need to understand your debt tolerance and make responsible decisions for actual gains. Moreover, you can also recycle debt—convert inefficient debt into efficient debt (that generates capital growth).

Using loans for passive income investments

So there are different types of financial freedom loans that will help you make investments that may generate returns and act as a passive income in the future:

- Peer-to-Peer Lending (P2P): You can lend money on platforms like Prosper and LendingClub and earn returns by charging interest on the amount. Historically, the average returns on this form of lending have been around 5.3 percent. Though, this requires accurate risk assessment and you should diversify your investment to minimize the risk from defaults.

- Real Estate Investment: Another popular, and perhaps the best commodity to invest in is real estate. When done smartly, the returns gained are amazing. Over time, 5-6 well-calculated investments can help you become totally free financially. While the upfront and management costs may be high, you can earn through rent (like AirBnB) for passive income.

- Business Funding: Investing in private businesses or equity funds can also generate passive income for you if that business succeeds. The method is riskier, and you need higher net worth or income to qualify as an accredited investor.

- Crowdfunding Real Estate: Platforms like Fundrise and RealtyMogul also allow you to invest in real estate projects, even though you have only smaller amounts to put in. The dividends or rental income can generate passive income for you.

Tips for risk assessment while borrowing

When you’re confused about whether a loan will help with or hinder your financial progress, just remember the 5 Cs—Capacity, Capital, Collateral, Conditions, and Character.

- Capacity: Understand your capacity to repay the loan based on your income, and the current financial obligations you have, if any. Debt-to-income (DTI) can help you with this. You must never take up more debt than what 30% of your income can cover monthly.

- Capital: This includes the assets you have, like savings, investments, or retirement accounts that can be used to repay the loan if you face any financial setbacks.

- Collateral: Again, your assets such as home can be used as collateral to borrow a secured loan at lower interest rates and better terms. However, if you default, the lender has the right to repossess your home or sell it to recover their funds.

- Conditions: The market conditions, state of the economy, etc. also influence whether taking the loan may be a good deal at the time or not.

- Character: A good credit history can help you secure lower interest rates on any loan.

You can say these are the factors that help you decide if you should go ahead and take the loan, and the factors that will help you get a loan.

Risks & benefits of using loans for financial freedom

Consolidating debt using personal loans

Now that you know the ins and outs of financial freedom, let’s explore one of the most crucial factors in determining how easy or hard it is for you to attain it. Debt—the more you have it, the longer you are kept from being truly financially free. If you’re able to handle the debt payments every month through passive income, then you indeed are financially charged up.

But, if you’re not, don’t beat yourself up, or pay more in unnecessary interest. Simply, consolidate your debt using a low-interest personal loan. You don’t need a great credit score, you don’t need collateral, you don’t need to go through heavy documentation.

Just apply through Best Rate Check, and you’ll instantly get pre-approved with reputable lenders. The platform uses advanced algorithms to filter out bad lenders who charge higher interest and offer poor, unfair terms to the borrowers. Individuals with bad credit are welcome too.

Final thoughts

Achieving financial freedom is slightly challenging because of obstacles like debt, monetary emergencies, excessive spending, and other issues. No doubt, it’s not going to be easy. Otherwise everyone would have been financially free, isn’t it? But it is doable.

You just need to stay mature and consistent. Get possessive about where your money goes every month. Plan your finances years in the future. Envision. Make investments that pay off. You don’t need to do anything grand—even the simplest of practices like disciplined budgeting, diversifying your investment portfolio, and training your mind to not crave joy from spending money can go a long way. Once you do become truly financially free, the struggle will feel worth it.

You need to prioritise long-term goals and make sacrifices in the short-term. Only then you’ll be able to support yourself in a monetary sense, without having to trade your time for money. And trust us, once you’re set on the path, not spending becomes easier. You’ll even start having fun!

Resources for financial freedom

Best books for financial freedom

Frequently Asked Questions

You will know. When you have enough income streams to support your living expenses, while also comfortably allowing you to spend on the things you desire, without relying on a traditional job, is when you’ve become financially free.

You can manage your debt by creating a clear plan. You can take a debt consolidation loan too, for combining high-interest debts into a single loan. That will help you to pay off faster, and later repay in single, manageable monthly payments. You may even qualify for lower interest than what you were paying in total previously.

Yes, credit score matters significantly for financial freedom. That is because a higher credit score gets you approved for loans easily, that too at lower rates. You can buy a home, or apply for a credit card with great rewards easily when your score is excellent.

The usual. When you’re taking out a loan, you don’t need to pay tax on the loan itself. But if you use the loan for making investments, the profits from dividends are taxed.

No, it is quite risky. It’s not recommended that you do so, unless you’re an experienced investor. If you’re okay with the potential benefits and drawbacks, know what you’re doing, and have a high risk tolerance, you may go ahead.